Compound Interest Calculator

In the world of personal finance, few concepts hold as much transformative power as compound interest. Often dubbed the “eighth wonder of the world” by Albert Einstein, compound interest isn’t just a mathematical formula—it’s a wealth-building strategy that can turn modest savings into substantial fortunes over time. Whether you’re a young professional in Guwahati starting your first investment or a seasoned saver looking to optimize your portfolio, understanding compound interest is key to financial independence.

In this comprehensive guide, we’ll dive deep into what compound interest is, how it works, real-world examples, and practical tips to harness its potential. By the end, you’ll be equipped to make smarter financial decisions that could significantly impact your future net worth. Let’s explore why compound interest deserves a prime spot in your financial toolkit.

What Is Compound Interest?

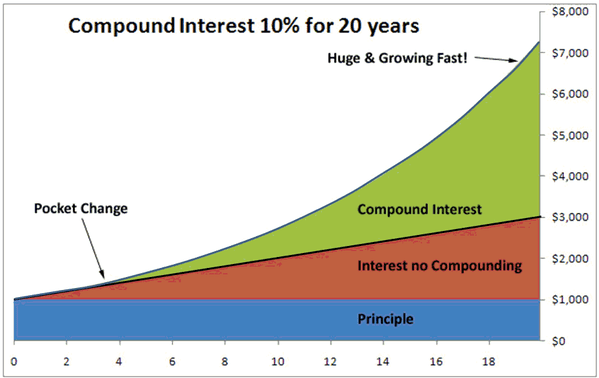

At its core, compound interest is the interest you earn on both your initial principal and the accumulated interest from previous periods. Unlike simple interest, which only calculates earnings on the original amount, compounding allows your money to grow exponentially.

Imagine planting a seed that not only grows into a tree but also produces more seeds that grow into additional trees. That’s compounding in action—your money works for you, generating returns that fuel further growth.

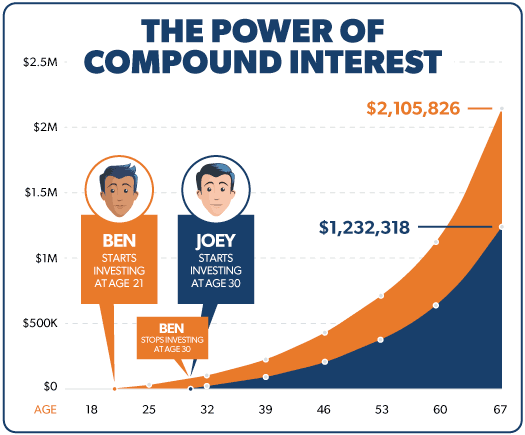

To visualize this, here’s a typical compound interest growth chart showing how an investment can accelerate over time:

How Does Compound Interest Work?

Compound interest operates on the principle of reinvesting earnings. The frequency of compounding—whether daily, monthly, quarterly, or annually—plays a crucial role in how quickly your investment grows. The more frequent the compounding, the greater the effect.

For instance, if you deposit $1,000 in a savings account with a 5% annual interest rate compounded monthly, your balance won’t just increase by $50 at year’s end. Instead, interest is calculated each month on the updated balance, leading to a higher yield.

Key factors influencing compound interest include:

- Principal Amount: The initial sum invested.

- Interest Rate: The annual percentage yield (APY).

- Compounding Frequency: How often interest is added (e.g., daily vs. yearly).

- Time Horizon: The longer the period, the more dramatic the growth.

In 2026, with global economies recovering and interest rates stabilizing, opportunities in high-yield savings accounts and index funds make compounding even more appealing for Indian investors.

The Compound Interest Formula Explained

The standard formula for calculating compound interest is:

A=P(1+nr)nt

Where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount.

- r is the annual interest rate (decimal).

- n is the number of times interest is compounded per year.

- t is the time the money is invested for in years.

For a closed-ended math question like this, let’s break it down step-by-step. Suppose P = $1,000, r = 0.05 (5%), n = 12 (monthly), t = 10 years.

- Calculate the rate per compounding period: r/n = 0.05/12 ≈ 0.004167.

- Add 1: 1 + 0.004167 = 1.004167.

- Raise to the power of total periods: (1.004167)^{12*10} = (1.004167)^{120} ≈ 1.647009.

- Multiply by principal: 1,000 * 1.647009 ≈ $1,647.01.

This means your $1,000 grows to about $1,647 after 10 years—a 64.7% increase, far surpassing simple interest’s 50%.

For hands-on calculations, tools like online compound interest calculators (which you can embed on your site) make it easy to experiment with different scenarios.

Real-World Examples of Compound Interest

Let’s make this tangible with unique scenarios tailored to everyday life in 2026.

Example 1: Savings Account Growth

A 25-year-old in Assam invests ₹50,000 in a fixed deposit at 7% annual interest, compounded quarterly. Using the formula:

A = 50,000 (1 + 0.07/4)^{4*30} ≈ ₹3,81,000 after 30 years.

This demonstrates how starting early amplifies results—delaying by 10 years might yield only ₹1,96,000.

Example 2: Stock Market Investments

Consider investing in an S&P 500 index fund with an average 10% annual return, compounded annually. A monthly ₹5,000 SIP (Systematic Investment Plan) over 20 years could grow to over ₹38 lakhs, factoring in market compounding.

Example 3: The Dark Side – Compound Interest on Debt

Compounding isn’t always positive. Credit card debt at 18% APR compounded monthly can balloon quickly. A ₹1,00,000 balance unpaid could double in about 4 years, highlighting the urgency of debt repayment.

Compound Interest vs. Simple Interest: Key Differences

Simple interest is straightforward: Interest = Principal × Rate × Time.

For the same $1,000 at 5% over 10 years:

- Simple: $1,000 + ($1,000 × 0.05 × 10) = $1,500.

- Compound (annual): ≈ $1,629.

The difference? Compounding adds $129 more, and the gap widens with time or frequency.

Use this comparison when choosing between loans or investments—always opt for compounding on assets, not liabilities.

Benefits of Compound Interest

- Exponential Growth: Turns small, consistent contributions into large sums.

- Passive Wealth Building: Your money earns while you sleep.

- Inflation Hedge: Outpaces rising costs in economies like India’s.

- Retirement Security: Essential for EPF, PPF, or mutual funds in 2026’s volatile markets.

Tips to Maximize Compound Interest

- Start Early: Time is your biggest ally—even small amounts compound massively.

- Reinvest Dividends: In stocks or mutual funds, let earnings compound.

- Choose High-Yield Options: Look for accounts with daily compounding.

- Avoid Withdrawals: Patience pays off; early dips hinder growth.

- Diversify: Spread across savings, stocks, and bonds for balanced compounding.

Common Mistakes to Avoid

- Underestimating fees that erode compounding.

- Ignoring tax implications on interest earnings.

- Chasing high-risk schemes promising unrealistic returns.

- Not automating investments, leading to inconsistency.

By steering clear of these, you can fully leverage compounding’s power.

Frequently Asked Questions (FAQs) About Compound Interest

What is the rule of 72 in compound interest?

The rule of 72 is a quick way to estimate how long it takes for an investment to double: Divide 72 by the annual interest rate. For example, at 8%, it takes about 9 years (72/8=9).

How is compound interest different from simple interest?

Simple interest is calculated only on the principal, while compound interest is on the principal plus accumulated interest, leading to faster growth.

Can compound interest make you rich?

Yes, especially with consistent investments over time. Billionaires like Warren Buffett attribute much of their wealth to long-term compounding.

What is the best frequency for compounding?

Daily or continuous compounding yields the highest returns, though monthly is common and effective.

How does inflation affect compound interest?

Inflation reduces purchasing power, so aim for returns exceeding inflation (e.g., 7-10% in India) to ensure real growth.

Is compound interest applicable to loans?

Yes, but it’s detrimental—interest compounds on unpaid balances, increasing debt rapidly.

What investments offer compound interest?

Savings accounts, fixed deposits, mutual funds, stocks, and retirement accounts like 401(k)s or India’s NPS.

How do I calculate compound interest with additional contributions?

Use an expanded formula or online calculators: A = P(1 + r/n)^{nt} + PMT × [{(1 + r/n)^{nt} – 1} / (r/n)], where PMT is periodic contribution.

Does compound interest work in a declining market?

In volatile markets, averaging down through regular investments can enhance compounding during recoveries.

Why is compound interest called the eighth wonder of the world?

Because its exponential nature can create immense wealth from humble beginnings, as if by magic.

Harnessing compound interest isn’t about get-rich-quick schemes—it’s about disciplined, long-term planning. Start today, and watch your financial future flourish. If you’re ready to crunch numbers, try our interactive compound interest calculator on this site!